THE PROBLEM

The best investments are locked away

Premium RWAs (real world assets) still remain inaccessible to crypto retail investors due to high capital requirements, poor liquidity, complex regulations, and outdated user experiences. The traditional investment landscape favors institutions while leaving individual investors behind.

The Solution

AI makes RWA investing simple

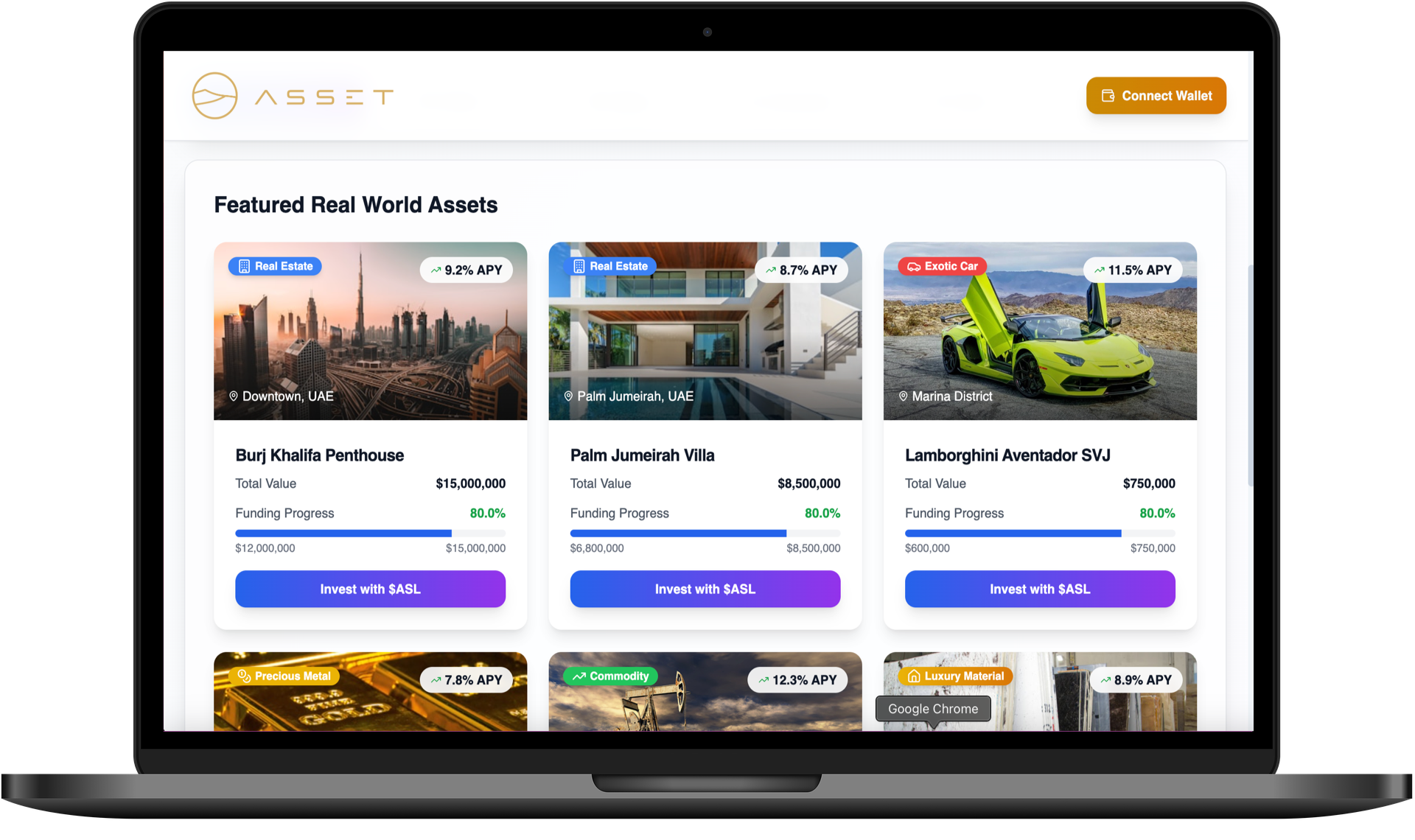

AssetLayer tokenizes premium assets, automates compliance and portfolio optimization with native AI agents, and fractionalizes ownership for global access. Our purpose-built Layer 1 makes institutional-grade investing available to everyone.

Process

How it works

Five simple steps to access institutional-grade investments

Discover

Browse curated premium assets from real estate to private equity, all verified and compliant.

AI Analysis

Our native AI agents assess risk, analyze market conditions, and provide personalized investment recommendations.

Verify

Automated compliance checks ensure all regulatory requirements are met before any transaction.

Purchase

Buy fractional ownership with as little as $100, making premium assets accessible to everyone.

Manage

Track performance, receive dividends, and optimize your portfolio with AI-powered insights.

Infrastructure

Purpose built for performance and compliance

Advanced AI-powered blockchain architecture designed specifically for real-world asset tokenization

Multi-Chain

Avalanche subnet architecture enables seamless cross-chain functionality and integration with traditional finance systems.

Compliant

Protocol-level compliance mechanisms ensure all transactions meet global regulatory standards with automated verification and reporting.

Scalable

High throughput architecture supports millions of users with lightning-fast transaction processing and real-time settlements.

Secure

Robust security measures protect user data and ensure transparent, tamper-proof transactions.

Market Opportunity

A $18.9 trillion market by 2033

The tokenized asset market is projected to grow from $0.6T in 2025 to $18.9T by 2033, representing unprecedented growth in digital asset adoption and real-world asset tokenization.

Source: Ripple and BCG Research

Token

$ASL powers the ecosystem

The native token that enables governance, staking rewards, and seamless transactions across the platform

Medium of Exchange

Primary currency for all platform transactions and asset purchases

Staking Asset

Stake $ASL to earn rewards and unlock premium platform features

Governance Token

Vote on protocol upgrades and participate in DAO decision-making

Deflationary Mechanics

Token burns and buybacks create sustainable value appreciation

Leadership

Built by industry experts

Seasoned professionals with deep expertise in blockchain, finance, and AI

Peter Peng

Co-Founder & Managing Partner

Peter has raised $10M+ for AI ventures, founded Jetson (partnered with Amazon and Shopify), and was an early pioneer in merging generative AI with blockchain through GPT Protocol, launched before AssetLayer.

Dr. Abdullah Al Harthi

Co-Founder & Partner

Dr. Abdulla Al Harthi, a PhD in AI Governance with 20+ years in tech, energy, and consulting, leads ventures in blockchain, Web3, and national tech policy, while advising on AI ethics and digital transformation across the UAE and beyond.

Be part of the movement bringing the next trillions on chain

Join the revolution in asset tokenization. Get early access to the platform that's democratizing institutional-grade investments and building the future of decentralized finance.